Audit Firm

in the Netherlands

- Understanding international businesses

- Deploying effective communication

- Bridging cultural differences

- Highest quality standards

A highly specialized audit firm in Amsterdam, the Netherlands

In order to comply with Dutch legislation, companies can be obligated to have a statutory audit of the year-end figures performed by a licenced audit firm. A financial audit is mandatory when at least two out of the following three criteria are met (for two consecutive years):

- The value of assets exceeds 7,5 million euros

- The net turnover is in excess of 15 million euros

- The company has over 50 employees

What does Reanda Netherlands bring for you?

Financial audits are highly complicated and regulations are frequently subject to change. Our specialists are continuously trained and have up to date knowledge on all areas at all times.

Cultural Awareness

Understanding your business need in a globalised world

Quality Standards

AFM license, member of NBA and SRA

Communication

Direct links between partners and stakeholders

Trusted audit firm for international companies

As a renowned audit firm in the Netherlands we are familiar with statutory audits for international companies. When banks, investors, local authorities or other stakeholders require an audit, we will perform a thorough audit that offers maximum assurance. Some situations, for example a legal merger, require an auditor’s opinion, often requested by insurance companies.

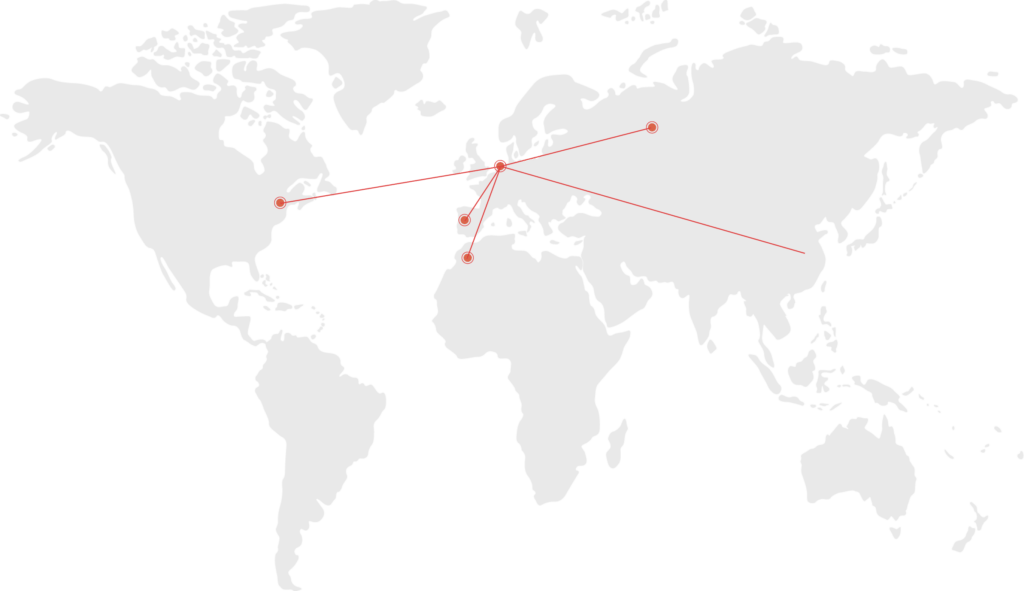

Our audit firm specializes in helping international companies comply to Dutch law and regulations in regard to audits. In fact, Reanda Netherlands is the only audit company in Amsterdam and the Netherlands who specializes in helping and supporting international companies who have the majority of their operations outside the Netherlands.

Even when the criteria for mandatory audits are not met, stakeholders can request or require financial audits. Whether mandatory or voluntarily, you want to trust in an experienced, reliable partner. Over the years we have made a name for ourselves and established valuable, long-term relationships. For many clients we have become their trusted audit firm in the Netherlands.

Financial audits are highly complicated and regulations are frequently subject to change. The specialists in our audit firm are continuously trained and have up to date knowledge on all areas at all times. Our auditors are able to fully integrate into any type of organization. Even though we work independently, they are always able to work together with any stakeholder, while maintaining their integrity.

Extensive knowledge of all holding structures

The legal system and tax climate make the Netherlands an attractive country for international companies to establish their holding. This means, however, that any international company based or active in the Netherlands must comply to both international and national law and legislations. The experts in our audit firm have extensive knowledge of all holding structures and can make sure financial administration is in full compliance. As an expert in any type of firm we can offer much more than a yearly audit.

We understand the needs of international oriented companies and can help them grow. We act as a group auditor, but are the only audit company in the Netherlands that offers service in areas such as risk management, compliance and much more. We speak your language, we understand your challenges and we are here to guide you through them.

Assurance

How our auditors can help you

Other, non-audit engagements that can be performed by an auditor are regulated as well. Example of such services are related to:

- Audit of condensed financial statements (NV COS 810)

- Audit engagement of historical financial overviews (NV COS 2400)

- Review of Interim Financial Information Performed by the Independent Auditor of the Entity (NV COS 2410)

- Assurance reports other than the engagement to audit and performance assurance on historical financial information (NV COS 3000)

- Investigation of future financial information (NV COS 3000), for example in business plans, financial projections and valuations;

- Agreed upon procedures (NV COS 4400)

What can we offer to you?

As a renowned audit company in the Netherlands we are familiar with statutory audits for international companies.

Usually associated with financial audits, an audit is the process of examining and evaluating the financial statements of an organization in order to determine whether the financial statements truly reflect the transactions occurred during the year and the economic health of the organization.

Assurance, which is very similar to audit is a professional service with the purpose of improving the accuracy, transparency and reliability of an organization’s financial statements. Assurance services are usually done by licensed external auditors. Technically an audit could be seen as a type of assurance.

Audits provide increased reliability and credibility to an organization’s financial statements. As a result this gives confidence to stakeholders and integrity of financial markets. Without audits the financial markets would be based on possibly fictitious financial statements which holds no value to society.

Audits usually take up to three months which consists of different phases such as planning, execution and finalization. However the timeframe can also be affected by other factors such as the company’s size and complexity of its structure and transactions.

It is essentially the same as an usual audit but it is legally required by law (also known as mandatory audit). For example, organizations that are publicly listed require mandatory audits.

A financial audit is the process of examining and evaluating the financial statements of an organization and it includes three main phases; planning, execution and finalization. Planning involves auditors conducting due diligence and risk assessment of the organization being audited. Execution is field work such as on-site inspections at the organization and analyzing its financial statements. Lastly finalization is producing the audit report which includes a statement whether the organization’s financial statements represent a true and fair view.

This depends on which country as each has its own requirements. The Netherlands for example has the following requirements; A financial audit is mandatory when at least two out of the following three criteria are met (for two consecutive years):

- The value of assets exceeds 6 million euros

- The net turnover is in excess of 12 million euros

- The company has over 50 employees

Reanda Netherlands is an AFM-licenced audit firm in the Netherlands, specialized in statutory audits. Our financial audits will provide stakeholders with as much assurance as possible.

The Audit Firms Supervision Act introduces public oversight by the Dutch Authority for the Financial Markets (AFM) on audit entities that provide audit reports that are relevant to the Dutch capital markets. Since 1 October 2006, audit firms need to have a license from the AFM in order to perform statutory audits in the Netherlands. Reanda Netherlands is an AFM-licenced audit firm in the Netherlands.